Student Loan Navigator | Formerly The Student Loan Nurse – Private Student Loan Consulting & Guidance

Work one-on-one with a student loan expert specializing in Public Student Loan Forgiveness (PSLF), Income-Driven Repayment Plans (IDR) and Consolidation.

Welcome! If student loan debt has you feeling overwhelmed, you’re in the right place. We specialize in helping students and graduates create clear, personalized repayment strategies that reduce stress, save money, and put you back in control of your financial future.

About Us

Student Loan Navigator (formerly known as The Student Loan Nurse) is a private company that provides expert guidance and consulting for individuals managing student loans. We help clients understand repayment options, navigate forgiveness programs, and make informed decisions about their student loans.

Please note: Emails from us ([email protected]) are company communications and are not government issued.

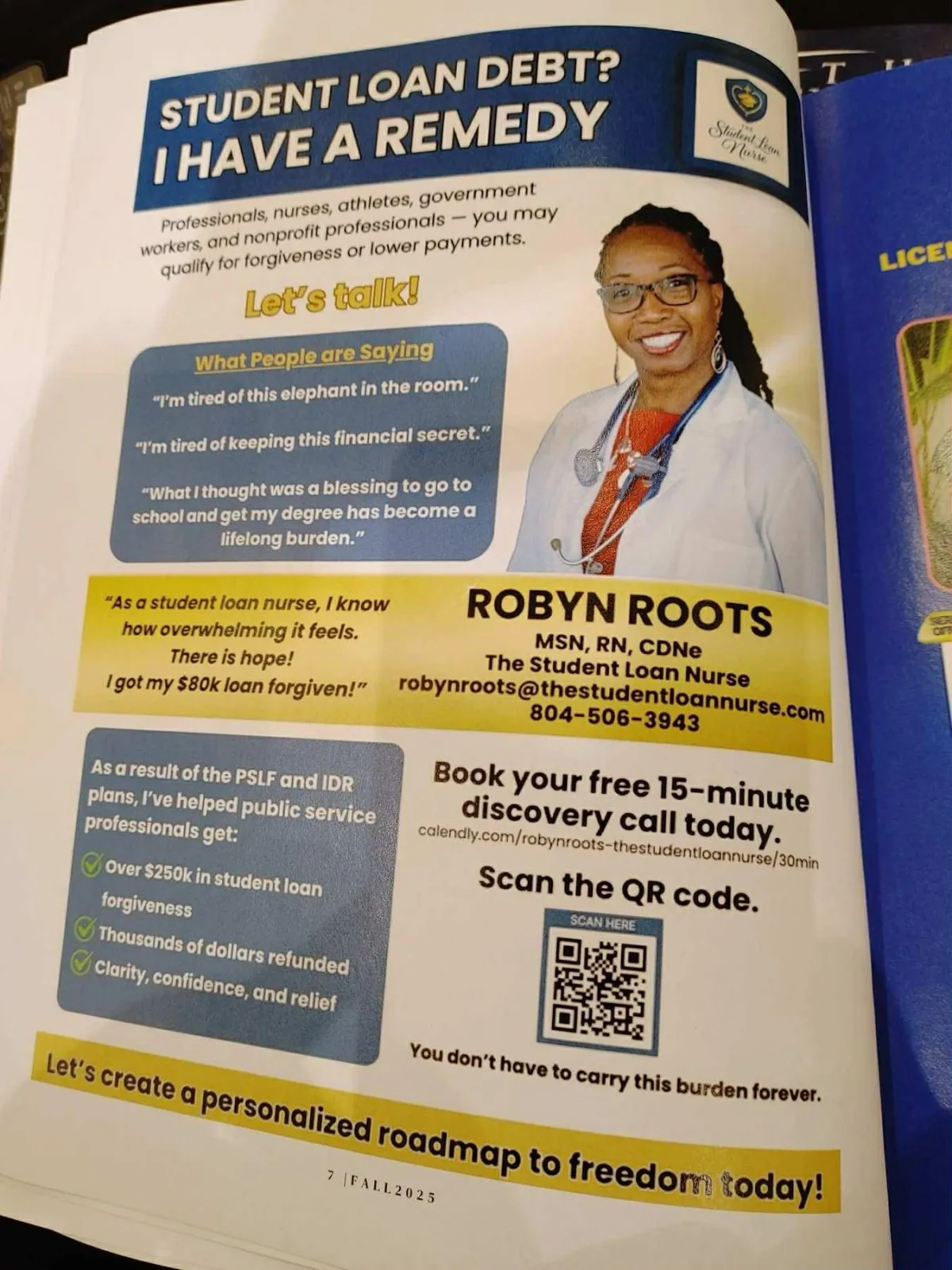

Professionals, nurses, athletes, government workers and nonprofit professionals — you may qualify for forgiveness or lower payments.

LET'S TALK!

What we hear most of the time…

“I’m tired of this elephant in the room.”

“I’m tired of keeping this financial secret.”

“What I thought was a blessing to go to school and get my degree has become a lifelong burden.”

DON'T WORRY! WE CAN HELP YOU!

Experience first-hand the proven strategies shared by the expert herself.

"As Student Loan Navigator, I know how overwhelming it feels. There is hope! I got my 80k loan forgiven!"

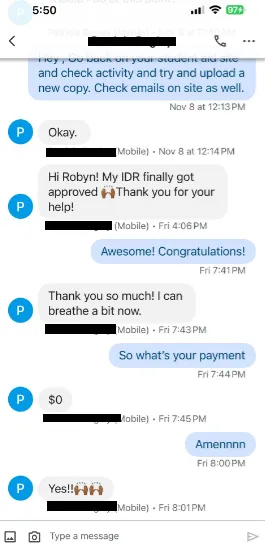

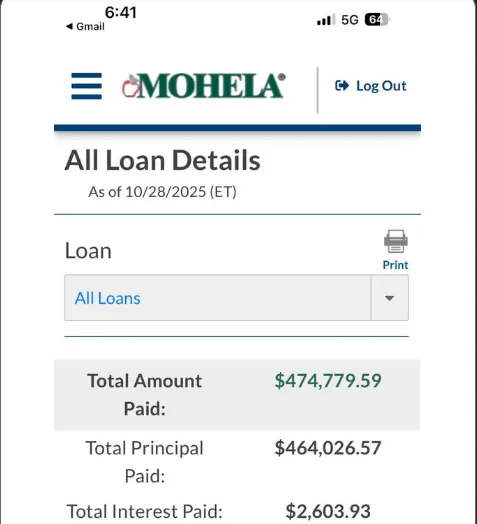

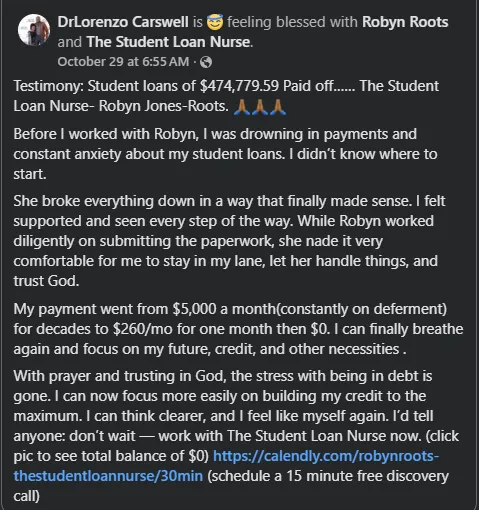

Testimonial/s:

"Student Loan Nurse sevices forgiveness is definitely working for me."

"Congratulations Robyn you always been innovative and whatever you do. One necessity that it provides is comfort and trust, knowing that the process is working. I've been knowing you for all my life, literally being next-door neighbors if you're looking for someone you can trust and will work diligently for you - Robyn is the one for you to trust. Just one word of advice - do not procrastinate move now, please. Congratulations again and may God continuously bless you more than you can think or ask."

- Dr. Lorenzo Carswell, CEIC

Events and Collaborations

Women Who Mean Business & The Women’s Ministry Spiritual Wellness Conference - 2025

The Platform Builder Summit - 2025

The Part II Podcast -2025

We Are The Expert

✅ Experienced Nurse & Loan Strategist

✅ Specialized in PSLF & IDR Programs & Consolidation

✅ Trusted by healthcare, nonprofit & government professionals

✅ Featured in national publications

We Are Trusted!

Why it Matters:

Understanding Loan Terms

Many students don’t fully grasp interest rates, repayment periods, and consequences of missed payments. A debt consultation helps break down these details clearly.

Preventing Financial Stress

Student loans can feel overwhelming. Speaking with a consultant provides clarity and reassurance, reducing stress and anxiety about repayment.

Learning Repayment Options

Consultants can explain income-driven repayment plans, deferment, forbearance, consolidation, or refinancing options tailored to the student’s situation.

Exploring Forgiveness Programs

Some careers (like teaching, healthcare, or public service) offer loan forgiveness. Consultants can guide students toward these opportunities.

Long-Term Financial Planning

Students often struggle with balancing limited income and expenses. Consultants can help create a realistic budget that incorporates loan payments.Loan repayment ties into future goals like buying a car, renting an apartment, or saving for a home. Debt consultation helps align repayment with life plans.

Improving Financial Literacy

Beyond loans, consultation teaches money management skills—such as saving, credit card use, and building good credit—that are valuable for life after graduation.

Scan to book a free 15-min discovery call

MEET THE student loan expert

Robyn Roots, MSN, RN, CDNe

Robyn's passion as a nurse has been serving people, including veterans, for 38 years.

She is a trusted Student Loan Expert and Financial Coach dedicated to helping students and graduates take control of their debt. With years of experience in loan repayment strategies and financial literacy, Robyn provides personalized guidance that empowers clients to reduce stress, lower costs, and build a clear path toward financial freedom.

Known for her compassionate approach and practical solutions, Robyn specializes in helping students overcome barriers to their loan debt journey. Whether it’s navigating repayment programs, understanding interest rates, or creating a budget plan, she helps students gain confidence and clarity in managing their finances.

Over $850,000 in loans forgiven

Thousands of dollars refunded

Clarity, confidence, and relief with PSLF and IDR plans

From overwhelmed to empowered — a student’s journey to finacial freedom.

You don't have to carry this burden forever. Let's help you!

For your student loan guidance inquiry, contact us at:

Official Student Loan Nurse Email –

Our expert:

Contact no: 804-506-3943

Please note: Emails from us are not government issued / we are a private company, not affiliated with Federal Student Aid.

As our goal is to help students manage their loans and build a clear path toward financial freedom. We also offer other service, which includes:

✅ Public Speaking

✅ Webinars

✅ Workshops

✅ Consultation

✅ Panel Expert Speaking Engagement

✅ Corporate Events

Copyrights 2025 | The Student Loan Nurse™ | All rights reserved.